Whether you are a salaried or a self-employed person, availing of a home loan is easy today and easier are home loan calculations. Forget lengthy time-consuming calculations -- the home loan calculator tool helps to seamlessly calculate your monthly home loan EMIs without error. In seconds, you can know the home loan EMI amount for a particular amount, tenor, and interest rate. The house loan calculator can also help you compare the home interest rates today and choose the best lender for you.

What Is a House Loan Calculator?

The housing loan calculator is an online financial planning tool that helps you calculate the home loan instalments i.e. EMIs (equated monthly instalments) that you need to pay to the bank till the loan amount is completely paid off. It gives reliable and accurate results for better planning.

How to Use a House Loan Calculator?

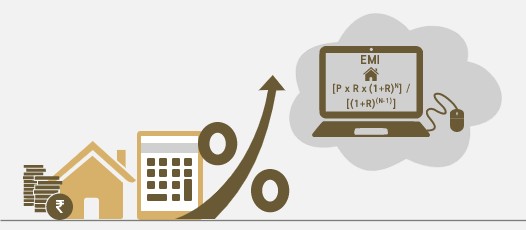

A house loan calculator is an online tool that helps to calculate your EMI for a home loan based on a specific interest rate charged by the lender and the tenor for the loan. To calculate your EMI, you can use the following formula:

e = [p x r x (1+r) n] / [(1+r) n-1]

Here, ‘e’ stands for the EMI amount that you want to find, p represents the principal loan amount, r is the interest rate charged by the lender, and n represents the loan term or tenor. So, if you want a home loan of INR 50 lacs for a term of 20 years at a 10% interest rate, your EMI for the same would be: e = [50, 00,000 x 10 x (1+10) 20] / [(1+10) 20-1]

In this scenario, EMI (e) equals INR 48,251 per month.

How Does House Loan Calculator Help?

The house loan calculator plays an important role in helping you choose a home loan. By calculating EMIs ahead of time with it, the calculator can assist planning for the home loan. The home loan calculator can help you in the following ways:

- Deciding the loan amount to be borrowed based on your monthly budget

- Planning your monthly budget to ensure EMI payments are made on time without defaulting

- Making a home loan prepayment plan

Features of a House Loan Calculator

A house loan calculator is an important tool and allows you to quickly calculate your EMIs. It is an online home loan calculator. Some important characteristic features of a home loan calculator are:

- Manual calculation of the home loan EMI can be difficult due to the large amount involved. The home loan calculator helps you to do the calculations quickly and achieve an error-free result

- It gives you a detailed breakdown of your monthly EMI for the home loan, including details, such as principal, interest, etc.

- Helps to show results for all amounts due until the last day of the home loan

- It helps to compare EMIs at various interest rates to find the best home loan lender for you

Benefits of House Loan Calculator

The benefits of using a house loan calculator are listed below:

- It helps in planning your monthly expenses based on your income

- Helps to know the total interest you will pay at the end of your loan term

- It helps you to understand whether to increase or decrease the loan tenor based on your budget

- The calculator is an easy-to-use tool and provides quick answers

- House loan calculators are reliable and produce accurate results every time in comparison to manual calculations.

- These calculators are really fast and once you enter all of the information, you will receive your monthly EMI and amortization schedule within seconds.

- They allow you to experiment with different loan amounts, interest rates, and tenor combinations as per your requirement. Trying out different combinations can help you zero in on the right combination for you.

- The online calculator helps to compare different offers from various lenders and select the one that best fits your budget.

- House loan EMI calculators are easy to use and completely free.

Final Words

Just as documents required for a home loan are a necessity for the loan to be passed by the lender, similarly planning for the home loan EMIs beforehand is also necessary. You do not need to sit with a pen and paper to do it manually. The home loan calculator has made life much easier for borrowers.

No need for difficult, lengthy, and time-consuming calculations. Just enter the required details in the house loan calculator and get an accurate result in the blink of an eye. So, understanding everything about a home loan is now easy.